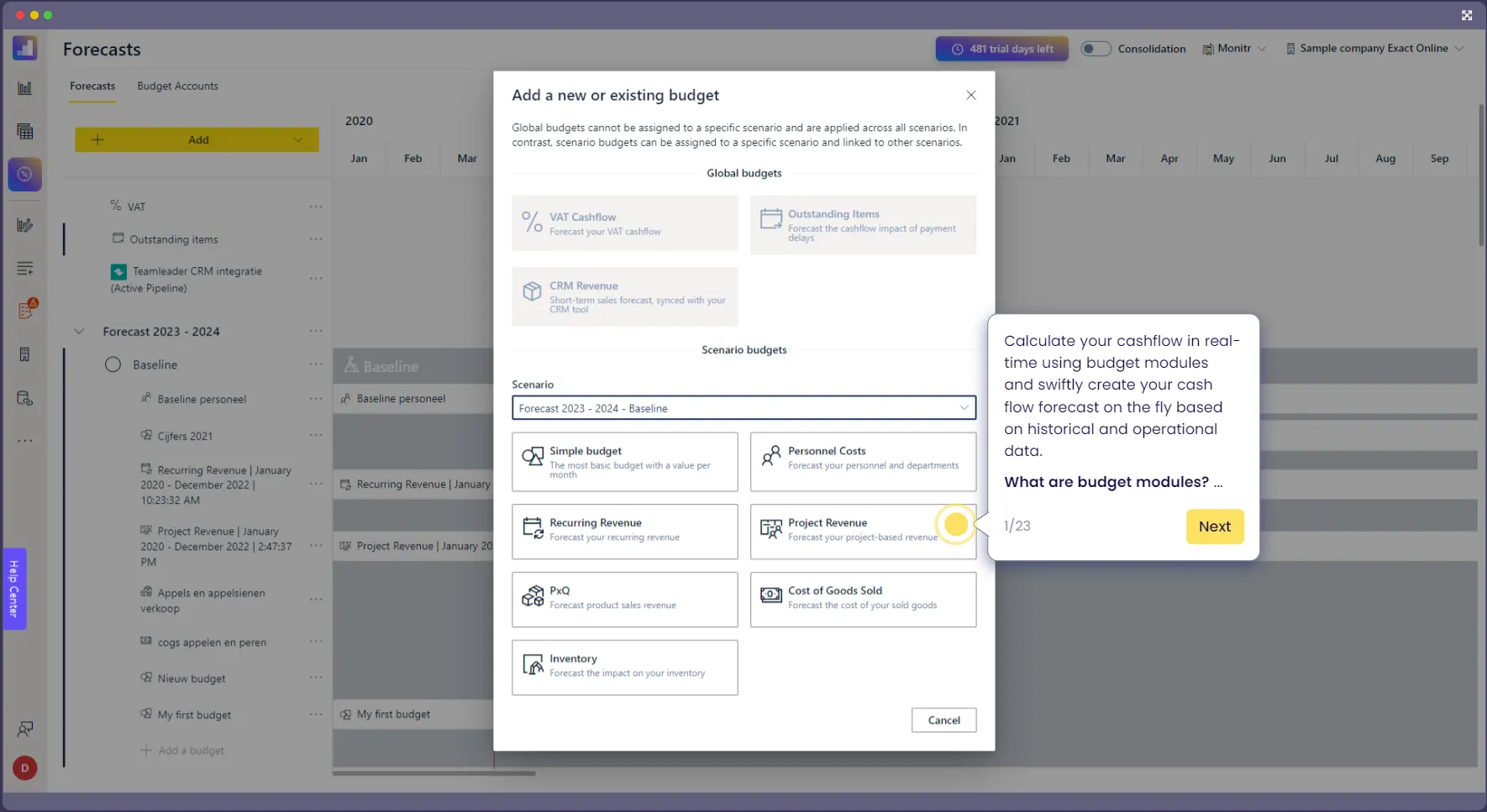

Compose your cash flow forecast in just a few clicks with budget modules

Use budget modules to calculate your cashflow in real-time. Calculate your cashflow using a best-practice calculation model and keep your data and your forecast up to date.

Built your budget using budget builder and calculate your cashflow and your figures in real-time

Calculate every part of your cash flow forecast with budget modules

Thanks to budget modules, you can create a cashflow forecast in just a few clicks. Furthermore, a budget module adapts specifically to your company's industry. Configure your budget module via a step by step configurator and view the result on your forecast in real-time.

Make use of operational data

Optimized on for your sector

Best practice cashflow calculation model

Update your numbers and forecast automatically in real-time

Build your budget on the fly and predict your cashflow with current figures

With Monitr, you can utilize budget modules to calculate your forecast from the ground up, simplifying the process of budget compilation. Each module is designed with a distinct purpose in mind. Rather than merely extrapolating past figures, you can simply compile a cashflow forecast on the go, that is both tailored to your business and characterized by reliability and accuracy.

Project income

Map the revenue from your projects. Get a more accurate picture of the capacity of your schedule and predict your turnover based on billability & rates.

Compare your current schedule versus your maximum capacity

Calculate billability and turnover per employee

Integrate your project planning

Staffing costs

Calculate your staff costs based on your staff plan. (Vacation, social security & end-of-year premiums are calculated automatically in your cash flow forecast.)

Easily create a staff plan and split your employees by department

Involve your employees as staff members (Intern) or (Consultant) and adjust their pay conditions individually

Break down all costs and costs of your employees in your cash flow forecast and automatically calculate the cost per department (Vacation allowance, 13th month, social security,...)

Cost of goods sold

Predict your cost of goods sold. Thanks to a handy configurator, calculate your gross margin per product and configure your cost categories individually per product level.

Assign costs by product category

Calculate your gross margin by product category

View the performance of your products via an interactive dashboard

Payables and receivables

Automatically include your outstanding customers & suppliers in your cashflow forecast and optionally apply payment delays.

Track outstanding payments and invoices in one screen

Request your invoices per customer or supplier level

Segment with age, analyse your outstanding payments and invoices into categories

Inventory Management

Keep a grip on your inventory and easily forecast your turnover. Estimate your purchases and set a safety stock per product category.

Configure a safety stock per product category

View the rotation of your inventory by product in one clear dashboard

Make a forecast of your expected purchases and update it with your cash flow forecast

Veelgestelde vragen

What are budget modules and how do they calculate my cash flow?

Monitr utilizes automated budget modules, which act as logical calculation models and effectively replace traditional spreadsheets. This significantly reduces the risk of errors in your numbers due to human mistakes, formula issues, or manual input, ensuring your cash flow is always calculated accurately. Additionally, Monitr's budget builder enhances this process, providing an intuitive and customizable approach to creating and managing your budgets in real-time.

How does Monitr calculate your budget and cashflow?

Monitr employs budget modules in conjunction with real-time data for dynamic and precise cashflow calculations, a stark contrast to traditional regression analysis methods that often rely on extrapolating numbers. For instance, if you purchase three cars for your employees in one year, regression analysis might inaccurately predict an increase to 1.28 more cars, over a course of five years. To avoid such inaccuracies, Monitr utilizes a budget builder and budget modules. This approach ensures that your figures are not merely drawn from the past but are calculated specifically and in real-time, for each segment of your cashflow forecast

How does a budget module improve the accuracy of my cashflow?

By switching from spreadsheets to budget modules, you significantly reduce the risk of errors by minimizing manual input. Additionally, you do not need to concern yourself about the intricacies of how your cash flow is calculated. Each module is tailored to match your industry, ensuring that your cash flow is accurately calculated and your figures remain up-to-date.

What is bottom-up forecasting and linear regression?

Bottom-up forecasting deconstructs your forecast into smaller components, calculates each one individually, and then aggregates them for a comprehensive and accurate forecast. This method calculates and adjusts your forecast in real-time, based on specific assumptions. In contrast, linear regression relies on historical data to predict future trends, meaning you review past figures and project them into the future. However, extrapolation carries inherent risks, the more your forecast extends into the future, the greater the potential inaccuracy or margin of error.

.webp)